Understanding the importance of superb risk management, Xoom’s leveraged customer data wisely, achieving an unprecedented 90%+ approval rate for transfers linked to a customer’s bank account. How did Xoom, once a global digital champion, end up in the current obscurity? Its business model evolved into a successful formula by 2007. One provider, in particular, Wise aka TransferWise, has been especially successful, eclipsing Xoom’s transfer volumes in mid-2015 just after four years in business:Įven for digital transfers Western Union is expanding the lead and Xoom was in the 3rd spot globally by 2019: Running Fast Is Not Enough Moreover, Xoom is now facing a new generation of remittance “disruptors” which are, with various degrees of success, repeating Xoom’s journey. Xoom’s transfer volume is eight times smaller than Western Union’s.

This brings us to the current state of Xoom which after all these years of trying to displace Western Union remains a marginal player in the global consumer remittances. Xoom became the slowest growing digital cross-border money transfer provider among well-known players including digital arms of Western Union and MoneyGram: These results were especially surprising as the overall market kept expanding: In late 2014, Xoom encountered a huge fraud case which made matters even worse but was much less important to investors than a long-term performance trend. Throughout 2015, the company performance was getting worse culminating with the first-ever decline in transfer volumes: Throughout 2013, the market still believed in Xoom’s disruptive abilities but, as quarterly results were coming it, by 2014 it became evident that this company was not “the next big thing.” Xoom’s stock started to plummet and quickly reached a below-IPO price, significantly underperforming its main competitors and the broader market: Such change was unexpected and caught post-IPO investors by surprise. Timing for IPO was impeccable as that year Xoom’s growth started decelerating, barely in 2013 but then significantly in 2014: With such performance and being named to the “ Top 50” VC-backed companies, Xoom was well-positioned for an IPO: on the first day of trading in February 2013, Xoom stock popped up almost 60%. In the following years, Xoom managed to accelerate growth tripling revenues from 2009’s $26 million to 2012’s $80 million. In those early days, Xoom was still a tiny company with less than $20 million in revenues (Western Union did $3.5 billion that year), but the playbook for growth was straightforward: convince as many customers in as many corridors as possible to try its application: Xoom Money Transfer: Digital tools By 2007, six years and five funding rounds later, Xoom had evolved to a business model known today: digital-only-consumer-focused service with instant money transfers and great user experience. … and its troubles started from the first years with frequent hiring mistakes and allocation of a significant portion of resources to a B2B pivot which ultimately failed. Xoom’s website was formally launched in 2003… The shift of remittances online was expected imminently, so creating an online-only provider with a better user experience was a no-brainer.

At that point, Western Union already had a website where customers could initiate and track money transfers, but it seemed clunky and wasn’t attracting much usage. The child of the so-called “PayPal Mafia” and protege of Sequoia Capital, Xoom was founded in 2001 to disrupt cross-border remittances.

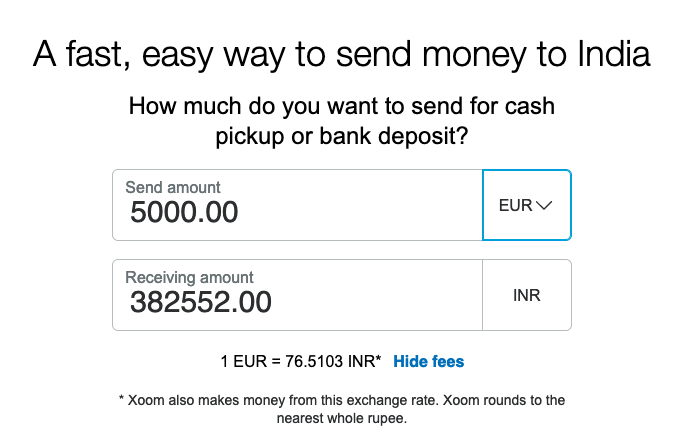

XOOM DOLLAR TO RUPEE FULL

Xoom’s fifteen-plus-years history is full of missed opportunities and second chances. think Western Union without the excessive fees…” TechCrunch, Sep 28, 2007

0 kommentar(er)

0 kommentar(er)